H1b tax calculator

On an H1B visa you have to pay Federal State Social Security and Medicare tax based on your. Prevailing Wage Level Calculator for H-1B H-1B1 E-3 and H-2B Visas and PERM Labor Certification.

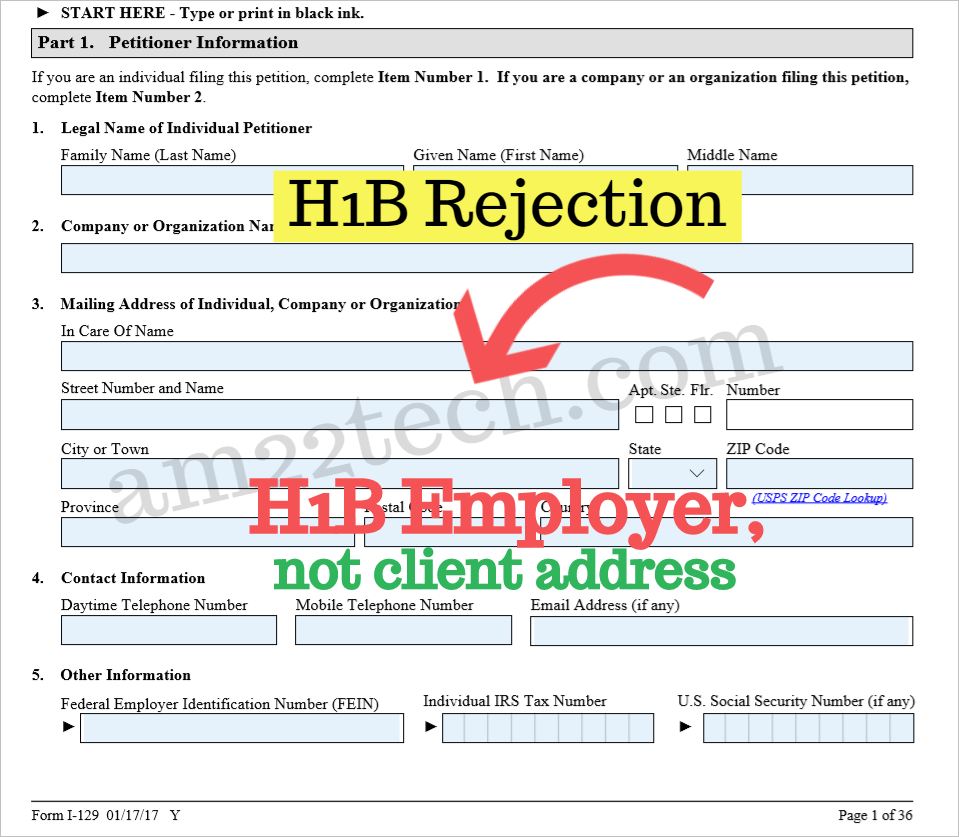

Uscis Will Reject H1b Without Employer Primary Us Office Address Usa

That means that your net pay will be 43041 per year or 3587 per month.

. Estimate your federal income tax withholding. It is mainly intended for residents of the US. See how your refund take-home pay or tax due are affected by withholding amount.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. H1-B aliens who claim treatment as residents of another country under the tie-breaker rules of a US. The amount of tax you can expect to pay on your income depends on a number of factors.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. And is based on the tax brackets of 2021 and. If you make 55000 a year living in the region of California USA you will be taxed 11676.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. That means that your net pay will be 43324 per year or 3610 per month. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Use this tool to.

Your household income location filing status and number of personal. See where that hard-earned money goes - with Federal Income Tax Social Security and other. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Depending on the income level an H-1B visa holder will pay between 20 percent and 37. Your tax rate fully depends on your level of income and the place you live in. Your average tax rate is 165 and your marginal tax rate is 297.

Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Your household income location filing status and number of personal. We can also help you understand some of the key factors that affect your tax return estimate. For instance an increase of.

Your household income location filing status and number of personal. This makes your total taxable income. Starting with your salary of 40000 your standard deduction of 12950 is deducted the personal exemption of 4050 is eliminated for 20182025.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that. Income tax treaty are treated as nonresident aliens for purposes of.

If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Tax Refunds Of Nonimmigrant Workers In The Us Taxes For Expats

This Is How Much Money You Save On H1b L1 Visa In Us 2022

H1b Lottery Chances What H 1b Lottery Results Say About Odds 2022

Us Tax Filing 2022 For 2021 H1b L1 H4 L2 Updates Deadline Rates E Filing Redbus2us

Texas Paycheck Calculator Smartasset

Filing Taxes On H1b Visa The Ultimate Guide

H1b Wait List Does Second Lottery Happen After April Usa

H1b Salary Comparably

Chances Of H1b Approval After Lottery 2021 22 Denial Rfe Steps Usa

This Is How Much Money You Save On H1b L1 Visa In Us 2022

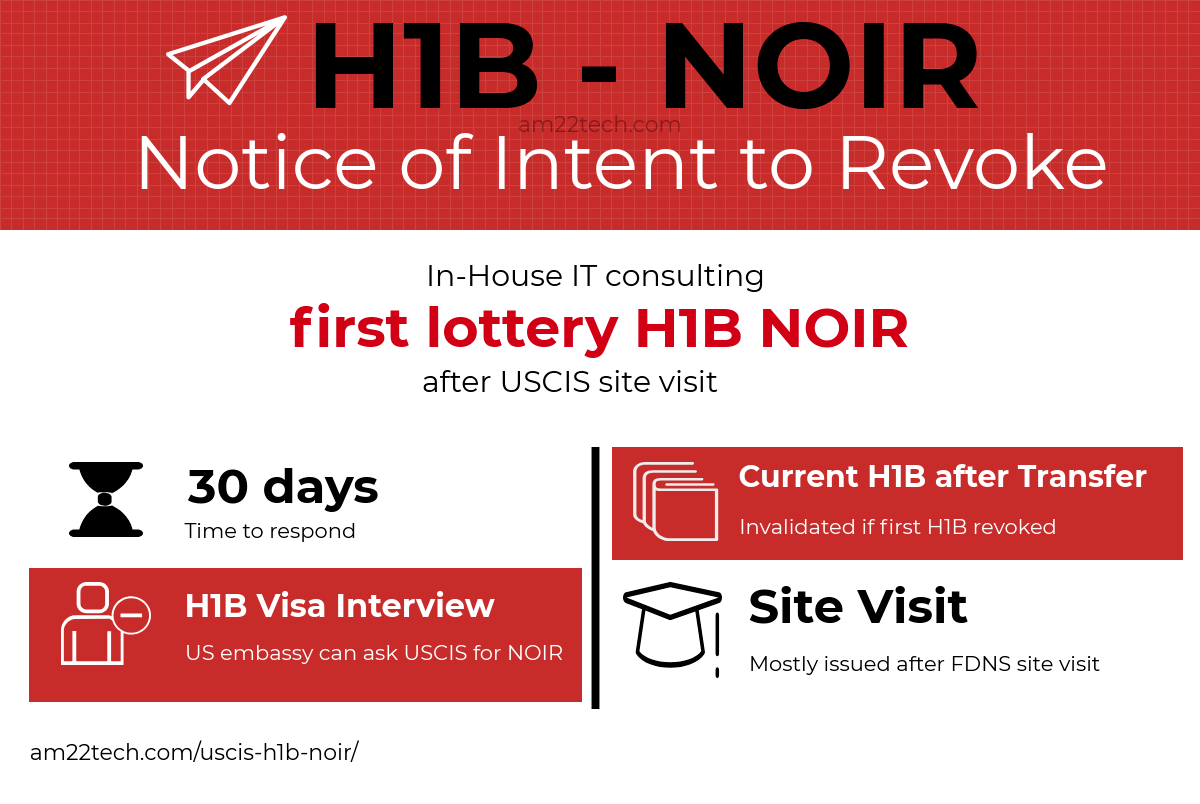

H1b Noir Uscis Notice Of Intent To Revoke Even For Past Approvals Usa

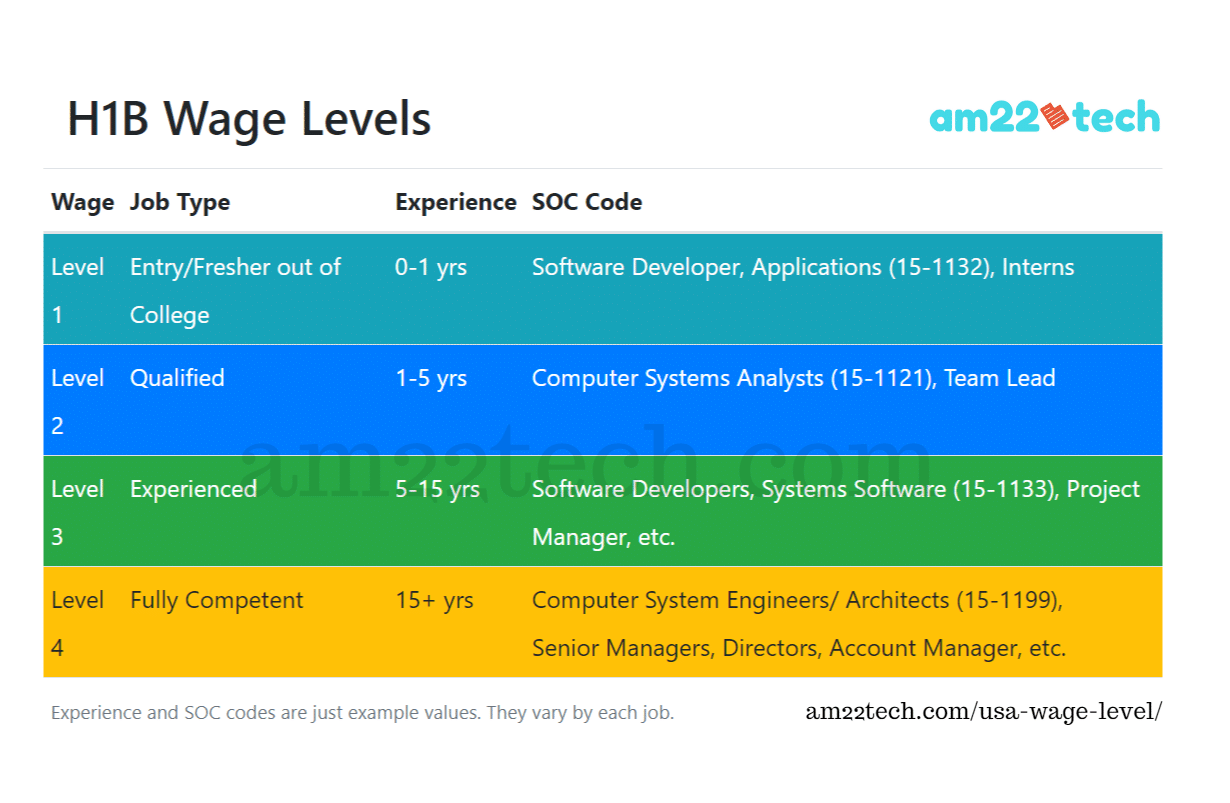

Can I Downgrade To Lower H1b Wage Level Lca Pwd Risks Usa

How To File Taxes For F1 Opt Stem H1b Visa Holders Non Residents Via Sprintax 2022

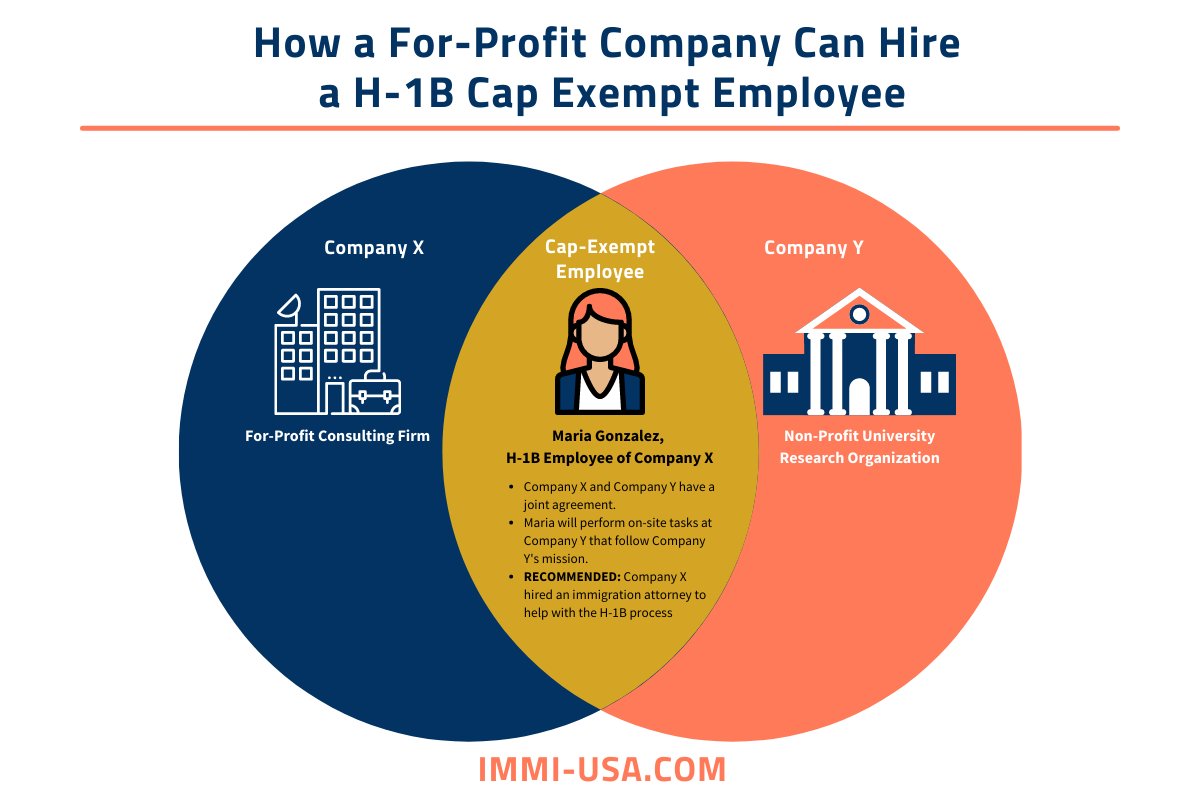

H 1b Cap Exempt Rules Employers And Process 2022 23

Can H1b Work From India Canada And Get Salary In Usa Usa

How Much Will I Pay In Income Tax While Working On An H1b In The Us

Am22tech Usa Australia Canada Immigration Visa Money Green Card Application Visa Academic Essay Writing