Traditional 401k calculator

Use a retirement calculator to estimate how much youll need to retire. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

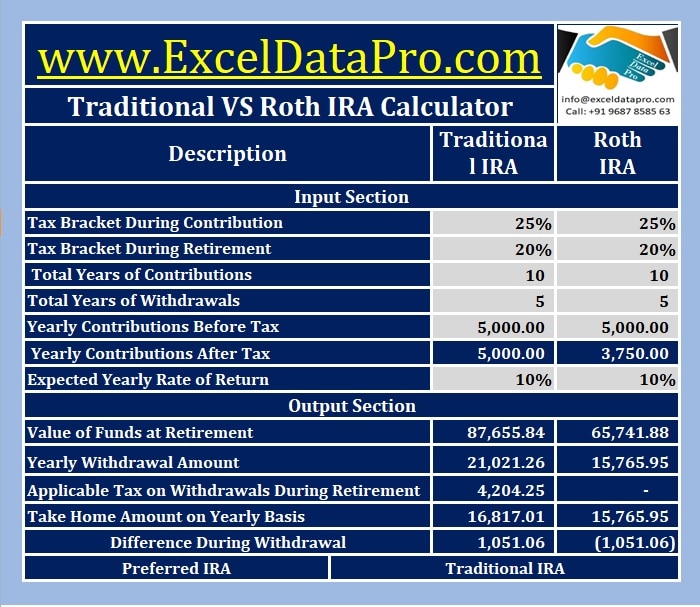

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

A traditional IRA is a tax-deferred retirement savings tool.

. Open Solo 401k Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred account. Make a smart decision.

Both plans offer tax advantages either now or in the future. A 401k contribution can be an effective retirement tool. As a rule of thumb the more frequently compounding occurs the greater the return.

Typically these limits change each year. The 403b is for non-profit and government employers while the 401k is offered by for-profit companies. If your employer offers a 401k plan consider contributing pre-tax money with every paycheck.

The only retirement plan that cannot roll into a Solo 401k is a Roth IRA as per IRS rules. Both plans are named for the section of the US. And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from.

Is Your 401k A Security Blanket. If you are under 59 12 you may also be subject to a 10 early withdrawal penalty. Roth 401k vs.

Some employers even offer contribution matching. With this information the builder can determine the amount of materials needed and design the ramp. 401k traditional IRA or Roth IRA.

Traditional SIMPLE and SEP IRAs have similar rules imposed by the IRS. Income tax code that created them. You can rollover almost any type of retirement plan into the Solo 401k including a traditional IRA another 401k plan 403b pension plan TSP etc.

Call 866-855-5635 or open a Schwab IRA today. You may defer your first RMD until April 1st in the year after you turn age 72 but then youd be required to take two distributions in that year. The calculator bases the results on a slope of 1 vertical inch for each 12 horizontal inches.

Heres more on the pros and cons of the IRA vs. With a Roth 401k income taxes only. Contributions come out of your paycheck after taxes but.

A close cousin of the traditional 401k the Roth 401k takes the tax treatment of a Roth IRA and applies it to your workplace plan. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. The exact date at which RMDs are required is April 1st of the year after a retiree reaches the age of 72.

The distributions are not completely tax-free. This is often stated as a 1 in 12 slope and is considered a standard in accessibility ramps. Solo 401k contribution calculation for a sole proprietorship partnership or an LLC taxed as a sole proprietorship.

Heres how to choose between a Roth IRA and a Traditional IRA Jump ahead for more tips on choosing between an IRA and a 401k. Choosing between a Roth vs. It shares certain similarities with a traditional 401k and a Roth IRA although there are important.

Individuals who want to save for retirement may have the option to invest in a 401k or Roth 401k plan. The Roth 401k allows you to contribute to your 401k account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn. Like all withdrawals from a traditional 401k or 403b you do have to pay income tax.

As of January 2006 there is a new type of 401k contribution. Contribute to your 401k. Traditional IRA Calculator can help you decide.

For some investors this could prove to be a better option than contributing. Wheelchair ramps are commonly built of wood cement or metal. A Solo 401k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan.

Try to meet or exceed their matching amount to make the most of your retirement savings. Roth 401k contributions allow you to contribute to your 401k account on an after-tax basis and pay no taxes on qualifying distributions when the money is. Traditional CDInvestors receive fixed interest rates over a specified period of time.

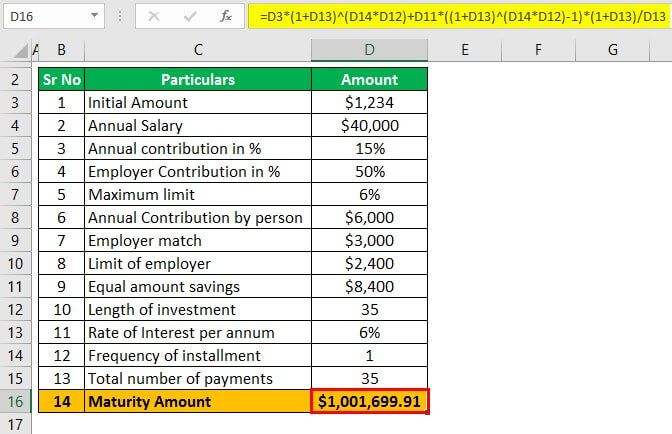

Inflation the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution. Only the 10 tax penalty is bypassed in this scenario.

With a Roth 401k your contributions are made. Traditional IRA depends on your income level and financial goals. With a traditional 401k you pay income taxes on any contributions and earnings you withdraw.

Early withdrawal rules are very similar for both Roth 401ks and traditional 401ks. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. The main difference is the income taxes you pay on your contributions.

Money can only. Footnote 2 Effective 112020 in accordance with new legislation the required beginning date for RMDs is age 72. Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account.

401k Withdrawing money from a 401k early comes with a 10 penalty. Traditional 401k Withdrawal Rules. A 401k can be an effective retirement tool.

With a traditional IRA you save today and are taxed when you withdraw the money. Footnote 1 Some rollover choices may not be available with respect to Roth employer plan assets. Use the calculator to let the math prove which is the optimum choice.

Traditional IRA contribution limits are based on how you file your taxes. To understand the differences between compounding frequencies or to do calculations involving them please use our Compound Interest Calculator. With a traditional 401k you defer income taxes on contributions and earnings.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation. Simple 401k Calculator Terms Definitions 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code.

-savings-detailed.png)

401k Calculator On Sale 58 Off Www Wtashows Com

401k Calculator Discount 57 Off Www Wtashows Com

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

Roth 401k Might Make You Richer Millennial Money

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Calculator On Sale 58 Off Www Wtashows Com

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download 401k Calculator Excel Template Exceldatapro

Roth Vs Traditional 401k Calculator Pensionmark